- Who We Are

- Our Programs

- Our mission is to empower families to gain access to decent, safe and affordable housing. This mission is fulfilled by partnering with families to become homeowners or improve the safety of their existing homes.

- Homebuyer

- Home Repair

- Almost Home

- Free Lead Remediation

- Rock the Block

- Global Support

- Construction Resources

- Homeowner Resources

- How You Can Help

- ReStore

Helping Families Afford the Essentials

Posted on November 5, 2025

Helping Families Afford the Essentials

What if you could save an extra $1,000 every month to invest in what truly matters: children’s futures, preparing for life’s emergencies, building a healthier more stable life?

That’s the power of partnering with Greater Fox Cities Area Habitat for Humanity. Our homebuyers purchase their homes with a 0% interest mortgage and a monthly payment that’s capped at no more than 30% of household income, and that cap factors in property taxes and utilities. The result is a payment families can sustain and a pathway to build wealth steadily, month after month.

Why this model changes everything

- Every dollar goes towards the principal. With no interest, monthly payments aren’t eaten up by finance charges—helping to build equity and stability faster.

- Affordability is built in. Payments are set so housing costs never exceed 30% of household income, including taxes and utilities. This ensures families can meet other needs without financial strain.

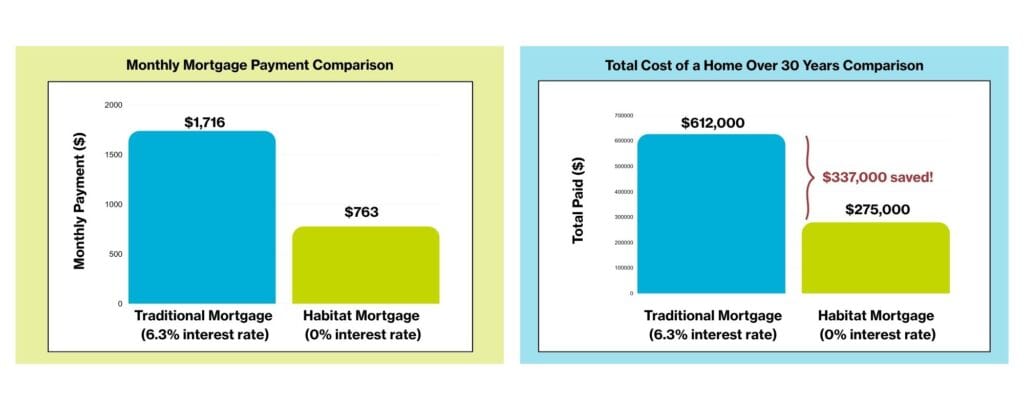

- Savings that spark opportunity. Fox Cities Habitat homeowners save nearly $1,000 each month—freeing up money for education, healthcare, and future goals. See the graphs below to learn how much a family can save with a Habitat mortgage.

Habitat homeowners are responsible for property tax, homeowners’ insurance and utilities, just like any other homeowner. The only difference is that their mortgage payments are sustainable and designed to help them build stability long term.

But what do these savings really mean for a family? It means more than just a roof over their heads—it means financial freedom. It means that an extra $1,000 every month stays in the family’s pocket instead of going toward interest payments. Savings that transform lives.

A Mortgage That Builds More Than a Home

When families no longer have to stretch every paycheck to cover housing costs, they can invest in what truly matters:

Investing in Their Children’s Future

That extra savings can fund a college account, pay for preschool or tutoring, or support extracurriculars that help children thrive. Over 10 years, $1000 a month kept in families pockets adds up to more than $120,000 toward a brighter future.

Building a Healthier Life

Families can afford nutritious food and preventative healthcare, reducing medical emergencies and improving overall well-being. Dental and vision care, often delayed due to cost, become affordable necessities.

Securing Stability

With reliable transportation, parents can get to work and kids to school. Families can manage car expenses, insurance, and even pursue higher-paying jobs or education.

Breaking the Cycle

Savings provide a cushion for emergencies and a pathway to long-term security. Homeownership helps families build wealth and stability that can last for generations.

Research shows that children who grow up in stable housing are:

✅ 25% more likely to graduate high school

✅ 116% more likely to graduate college

✅ Healthier, with lower stress and better mental well-being

Who partners with Habitat—and how selection works

Families apply through a thoughtful, community-led process that evaluates three things:

- Need for housing (overcrowded, unsafe, or unaffordable conditions)

- Willingness to partner (200–400 hours of sweat equity and homeownership classes, among other partnership criteria)

- Ability to pay (stable income to make the affordable monthly payment)

What Keeps Habitat Homes Affordable Long-term

Affordability is made possible through our generous community. Donations, sponsorships, and proceeds from shoppers at our Appleton Habitat ReStore help fund the costs of building homes. Volunteers and donations of materials and professional services (Gifts in Kind) help lower construction costs from the start. As homeowners make their monthly payments, that money is reinvested to build the next homes—creating a cycle of giving that keeps Habitat homes affordable for generations.

Thoughtfully Built for the Long Haul

Habitat homes are simple, modest, and energy-efficient, typically under 1,200 square feet and tailored to fit each family’s needs. Lower maintenance and reasonable utility costs help keep the total cost of homeownership manageable.

When families thrive, communities thrive. Each Habitat home represents not just affordable housing, but a ripple of impact—stronger finances, greater confidence, and a lasting feeling of hope. Together, we’re not just building homes; we’re building a better future for generations to come.