- Who We Are

- Our Programs

- Our mission is to empower families to gain access to decent, safe and affordable housing. This mission is fulfilled by partnering with families to become homeowners or improve the safety of their existing homes.

- Homebuyer

- Home Repair

- Free Lead Remediation

- Rock the Block

- Almost Home

- Global Support

- Construction Resources

- Homeowner Resources

- How You Can Help

- ReStore

2023 State of the Nation’s Housing

Posted on November 1, 2023

2023 State of the Nation’s Housing:

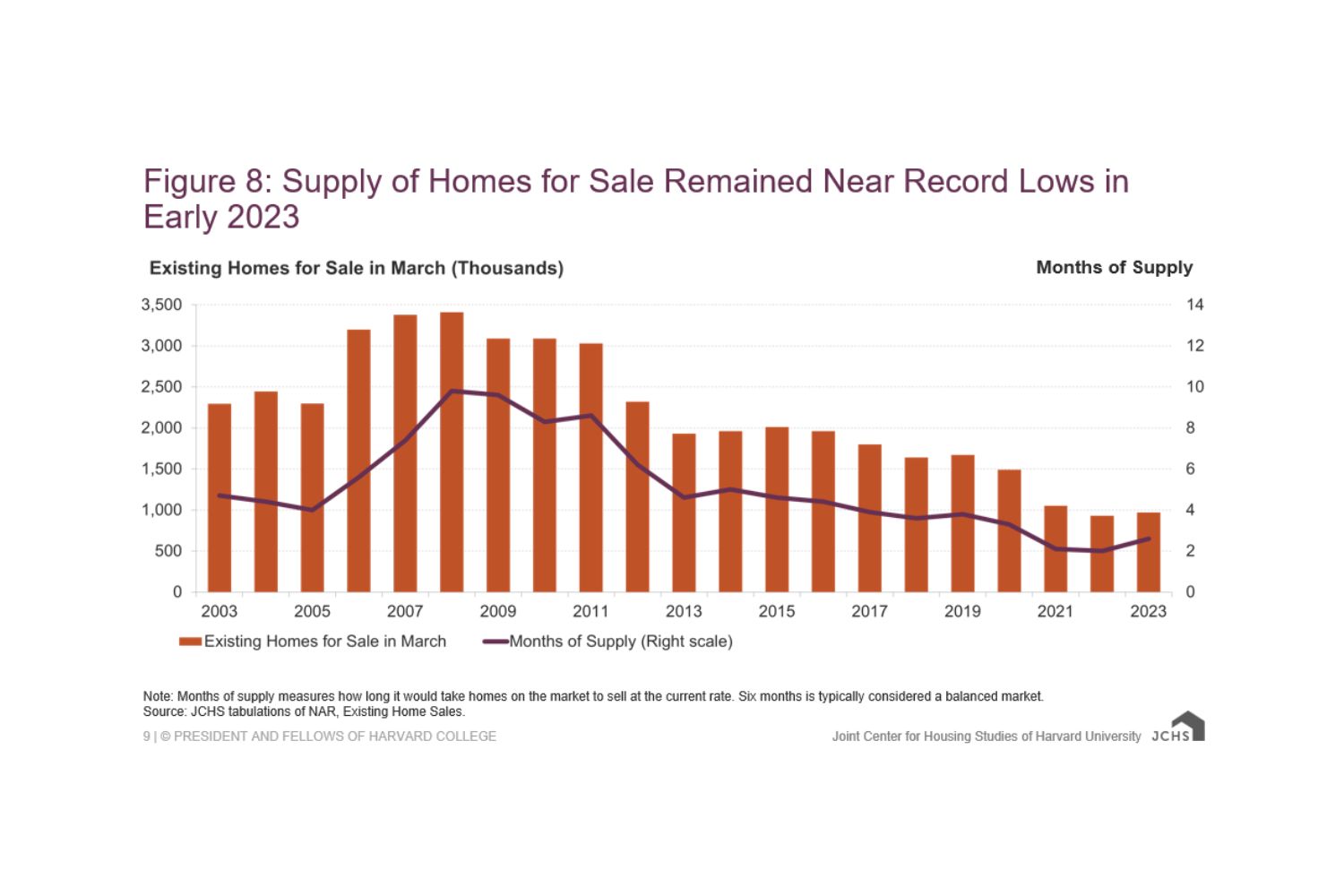

The 2023 State of the Nation’s Housing report created by Harvard University highlights the record need for safe and affordable housing throughout the United States. Housing costs have reached their highest levels in years, while the supply of homes for sale has reached a new record low– the shortage being even greater for lower-priced homes.

“Cost-burdened” refers to households that spend 30% or more of their income on housing expenses while “severely cost-burdened” households spend 50% or more. This financial strain affects low-income households’ ability to cover basic needs for a successful household such as food, healthcare, utilities, education, and more. It can lead to constant stress, limited savings, and increased risks of housing instability. Households that find themselves in these situations have a difficult time bouncing back from unexpected life events.

In 2021, housing cost burdens significantly increased, affecting both homeowners and renters nationwide. For homeowners, 22.7% were cost-burdened (22% in Wisconsin), with 10.4% being severely cost burdened. Renters faced a similar, if not worse, situation, with 49% experiencing cost burdens (43% in Wisconsin), and 26.4% of them paying over half of their income for housing. In total, 1 in 3 of all households nationwide (40.6 million) were cost-burdened in 2021, with 15.9% considered severely cost-burdened.

A decent place to live, renting or owning, is taking a bigger chunk out of the paychecks of hard working families. It’s felt nationally, in Wisconsin, and locally in the Greater Fox Cities. In Outagamie county, the number of cost-burdened families has decreased from 28.66% in 2010 to 19.64% in 2021, but much more progress is needed.

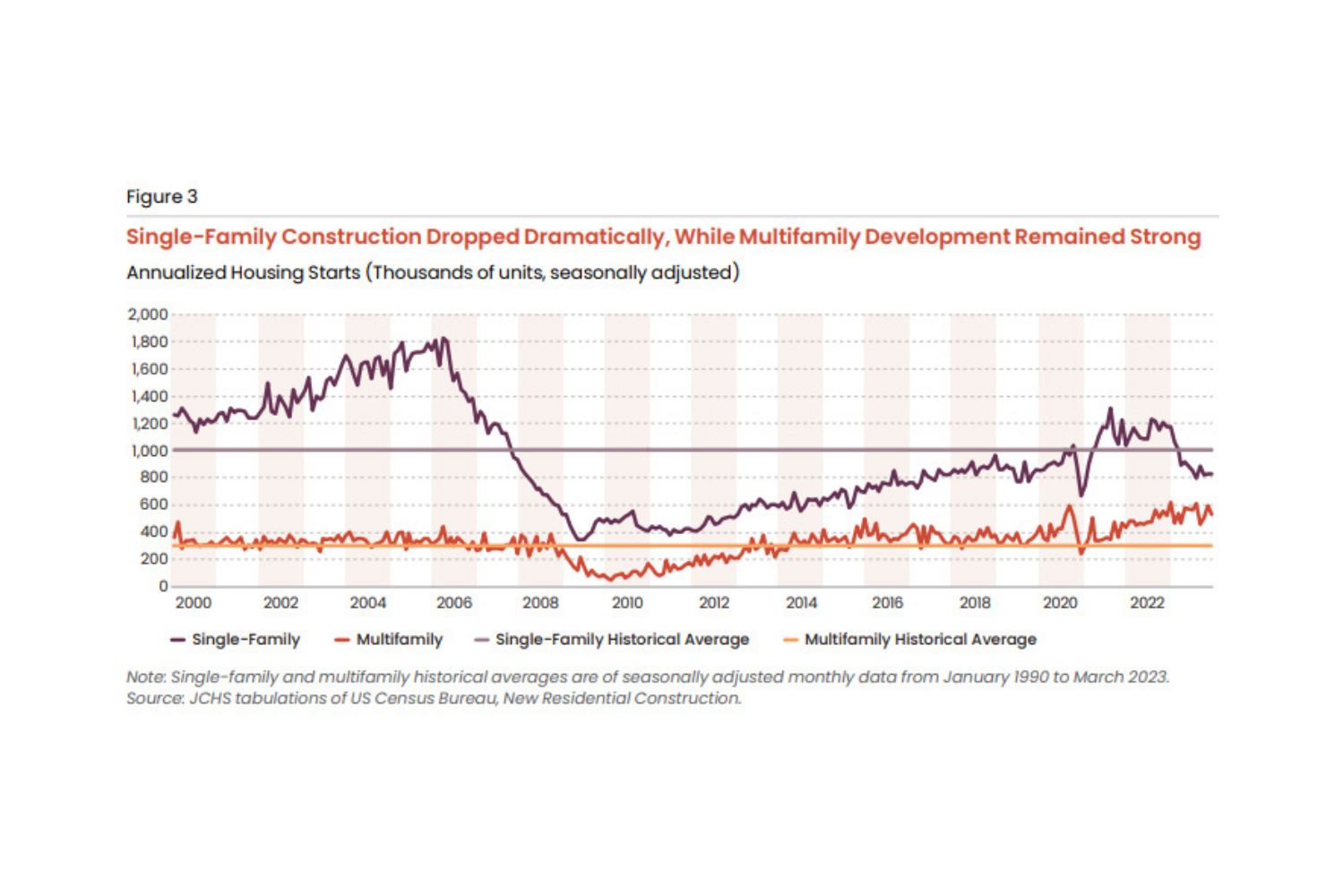

Housing shortages are greatest for lower priced homes. Adding to this challenge, modest-sized home construction is continuing to decline every year. The Joint Center for Housing Studies reports that less than a quarter of new homes were under 1,800 square feet in 2021, compared with 37% in 1999. Escalating land costs, material expenses, and hurdles such as zoning limitations pose significant obstacles for both nonprofit and for-profit housing developers in constructing reasonably-sized, cost-effective residences. Fox Cities Habitat has been effective in this space as new builds average 950-1,000 square feet.

The Fox Cities Habitat Homebuyer program allows qualified, low income, hard working people in the Fox Cities to purchase a home with a 0% interest mortgage loan. They then go on to pay monthly mortgage payments that include repayment to Fox Cities Habitat for the home’s principal amount, the property taxes and home insurance. Their hard work doesn’t stop there as all Fox Cities Habitat Homebuyer families are required to complete 200-400 hours of Sweat Equity while working towards their goal of homeownership. Sweat Equity hours can come in many different forms – swinging a hammer (often working on their own future home), volunteering at the ReStore, cooking a meal for volunteers, attending homeowner workshops, and more! This sets homeowners up for success, gives them a chance to pay it forward, and allows them to earn their interest-free home loan. A hand up, not a hand out.

Habitat for Humanity Affiliates across Wisconsin, and the entire country, have been working together to help break down these barriers and address affordable homeownership. That being said, we cannot solve this problem alone. Together, Wisconsin Habitat Affiliates are encouraging the development of a program that provides gap financing for first-time homebuyers with incomes up to 120% of the area median income (AMI). This gap financing, if approved as designed, would allow families to get into an affordable home where they can have a sense of security while they start to build equity and wealth. It would also be a perpetually self-funded financing tool that is refilled by homeowners paying back their loans.

As the 2023 State of The Nation’s Housing report made clear, the significance of our work has never been greater. We deeply appreciate your contributions in supporting us to fulfill our mission of providing safe and affordable housing for families in our community, allowing us to play a small part in a much needed solution.

To support our efforts of providing affordable housing across the Fox Cities, please visit our donate page.